Singapore offers countless possibilities to entrepreneurs, making the country one of the best places in the world to start a business. The government regulates different business entities. So for people looking for flexibility, setting up a private limited company in Singapore is a good choice.

What is a Private Limited Company?

A Private Limited Company or Pte. Ltd. in Singapore is limited by shares. Aside from being a separate legal entity from its shareholders, it is also considered a taxable entity in its own right. In line with that, the owners or shareholders of a private limited company in Singapore are not liable for the debts and losses incurred by the business.

Incorporating a private limited company presents advantages and disadvantages—just like any other business entity. Some of its benefits include entitlement to tax incentives and exemptions for newly-incorporated businesses, and shareholders are not personally liable for the company’s debts and losses.

What are ACRA’s requirements when setting up a Private Limited Company in Singapore?

The Accounting and Corporate Regulatory Authority or ACRA in Singapore requires all entrepreneurs to register their business through BizFile. If a company is not registered with ACRA, it cannot operate in the country.

In addition to the online registration, individuals who want to set up a private limited company need to meet these minimum requirements:

- One resident director

- One company secretary

- One shareholder (must be an individual or a corporate entity)

- A physical office address

- Initial paid-up share capital of at least $1

Below are the necessary documents when setting up a private limited company in Singapore:

- Company name. Deciding on a company name is important as it will help build your brand. You may check the availability of your preferred company name through the BizFile website.

- Description of Business Activities. Refer to Singapore Standard Industrial Classification (SSIC) Code for a complete list of business activities.

- Description of share capital. It indicates the total amount paid by each shareholder for their shares.

- Details of the Company Particulars. This section includes information about the shareholders, directors, company secretary, and registered address. A shareholder agreement must also be in place to avoid future conflicts.

- Notarized Memorandum and Articles of Association. These documents indicate the characteristics of your company and how it is internally regulated.

- Business Profile. This is the confirmation of your company’s incorporation. An incorporation certificate is also available for purchase if needed.

- Share Certificate. It serves as proof of shared ownership.

- Board Resolution. The first BR that makes the appointment of the company particulars official.

- Corporate Account Opening Resolution. It serves as an approval of your business bank account opening.

Other Considerations in Company Incorporation in Singapore

Cost

In any type of business, one of the most important considerations is the cost. This factor includes compliance, service, and administrative costs. Compliance costs include the screening of the company’s personnel that can help prevent money laundering. Service expense includes the level of professional knowledge of your preferred secretarial service. Generally, a more senior individual incurs a higher cost.

Administrative costs, on the other hand, are disbursement expenses that include filing of annual returns, special resolutions, and other alterations in the company’s particulars. These are just a few of the other costs involved in company registration in Singapore.

Company Registration Number Check

A Singapore company registration number check is performed by any individuals who want to work with a certain company. It is also known as the Unique Entity Number (UEN) which serves as the official identification of a business. It helps the public determine if a company is in good standing.

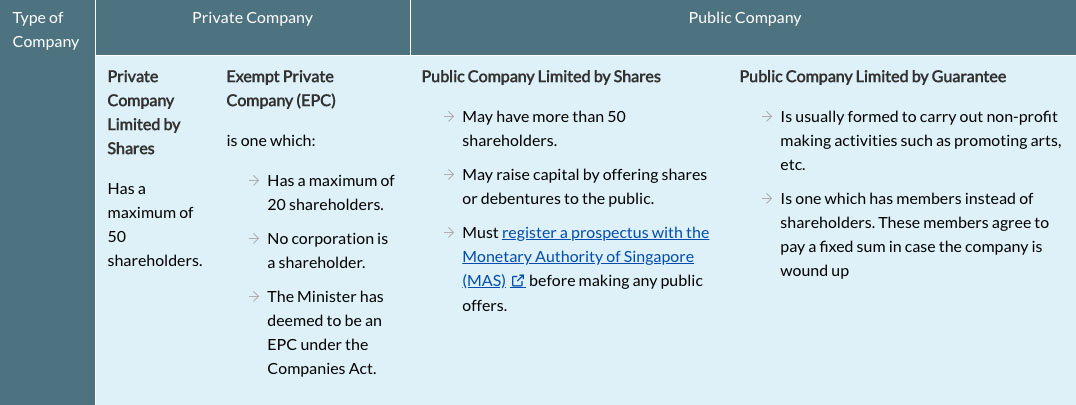

Exempt Private Company Limited by Shares vs Public Company Limited by Shares

Exempt Private Company Limited by Shares

In a private limited company, the maximum number of shareholders is 50. However, in an exempt private company limited by shares (EPC), it can only hold up to 20 members as its shareholders.

Public Company Limited by Shares

It is a locally incorporated company that allows more than 50 shareholders. This type of business entity may or may not be listed on the stock exchange. The company may also raise their business capital by offering shares and debentures to the public.

Leave A Comment